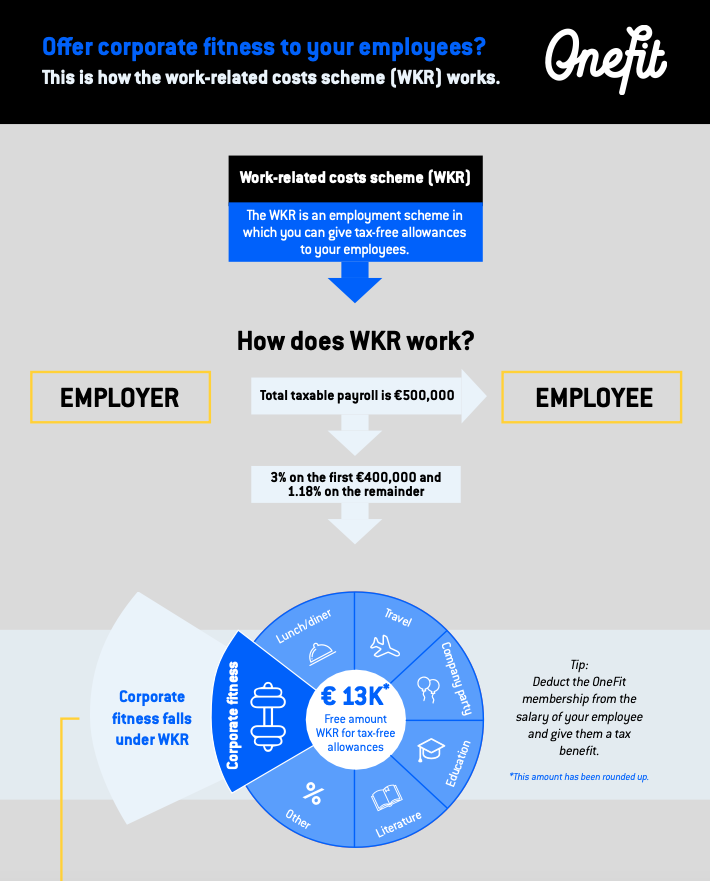

This allowance is handy if you want to offer employees some extras. Think about tools, company parties, Christmas presents, or other allowances that can also benefit the employee privately. One option can be offering your employees OneFit for Business: this counts as tax-free allowances.

Free WKR space

With the WKR, you can spend a maximum of 3% of the taxable wage bill up to (and including) € 400,000, plus 1.2% of the remainder of that bill on untaxed allowances and benefits for your employees.

This is the so-called “Pot” of Joy. You do not pay wage tax on this. This Pot must remain below 3% of the total wage bill of all employees. If you spend above that, you pay 80% tax on the rest. So, suppose the total tax wage bill is € 400,000, so you can spend € 12,000 on untaxed allowances.

So why not spend some of that on an employee fitness scheme? This would be something for everyone. OneFit is a flexible fitness app that will suit the needs of every employee. One may use the app to swim twice a week. One may go kickboxing, one may prefer yoga at their local studio on weekends. Employees can invite each other. Whilst they work at your company, each workout or lesson booked with OneFit will feel like a meaningful and tangible gift.

An employee always benefits from tax-free allowances. It improves work ethics, and motivation, and is a pillar for mental health. Physical health is one of the most important things when it comes to the well-being of employees, so why not invest (tax-free) in that? With OneFit for Business, they’re given a flexible option to stay healthy when and wherever they want. Something that benefits the company in the long run.

Click on the infographic below to enlarge.

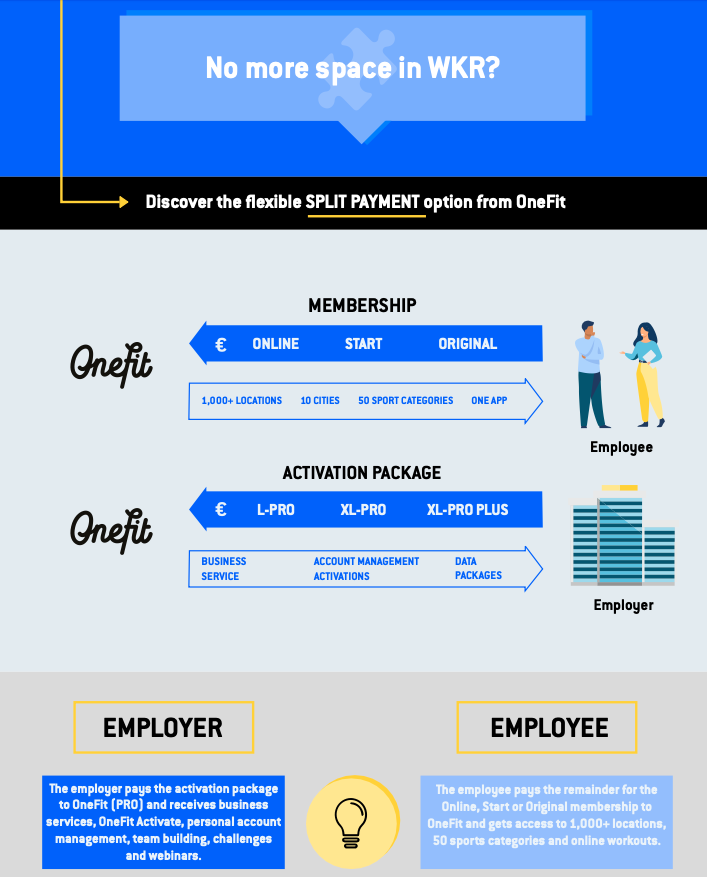

The flexible split payment option

Is your tax-free WKR space full or exceeded? OneFit for Business still makes it possible to offer employees company fitness without using tax-free WKR space. Calculate the membership costs into your employees’ salaries and it’ll bring a financial benefit that doesn’t take up free WKR space.

It’s all explained easily in the infographic. Here’s everything lined up, so everything that’s possible with the split payment option is clear at once.

Because the employee pays for the membership himself, which is then added up to his salary, it doesn’t fall under the WKR because it’s no benefit paid by the company. That way the sports membership doesn’t take up tax-free WKR space, which makes it possible to offer different benefits as well.

Company fitness for your employees

What are you waiting for? The OneFit for Business team is ready to answer all your questions and help you get started. Plan a call via our website or request a brochure for more information.

Stay fit, stay healthy.

This is not tax advice: OneFit relies on a memorandum from Amstone Tax Advisors, dated 26-01-2020.